Email: info@prgmd.com | Call: +1 (630) 242-6474

Business hours: 9:00 to 5:00 | Monday to Friday

Email: info@prgmd.com | Call: +1 (630) 242-6474

Business hours: 9:00 to 5:00 | Monday to Friday

Table of Contents

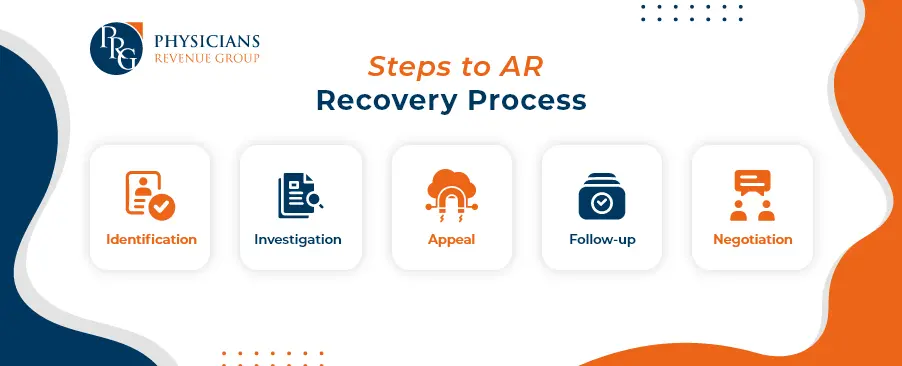

ToggleAll healthcare practices must perform their medical billing and coding efficiently and qualitatively. Therefore, outsourcing medical billing services improves the clean claims rate. However, claim rejections, denials, and underpayments – are all part of the billing process. Most medical practices experience financial constraints – resulting from not working keenly on denials and ignoring the unpaid claims. There is, however, an excellent chance to recoup the missed revenue – if they are reworked and appealed to the payers. That brings us to the AR recovery process, where the claim denials are followed up to maximize reimbursement rates. An effective AR recovery process assists in recovering the aging claims’ payments.

Denials in medical billing are classified through an accounts receivable aging report, taking into account the total number of days payments remain outstanding. The AR recovery process is vital in medical practices because the longer claims linger on the aging list, the less likely they are to be paid.

The denial management and AR follow-up teams ensure the success of this process. They are responsible for reworking denials and appeals in the reimbursement queue. Continuous follow-ups become vital not only to collect the funds but also to close the claim constructively.

In essence, the process immensely impacts medical billing. By efficiently managing denials through systematic follow-ups, healthcare practices increase their chances of securing timely payments, strengthening their financial health.

With constant claims monitoring, it becomes easier to determine:

Or

This approach allows for a quick analysis of the collection percentage. Moreover, it enables the Accounts Receivable team to follow up on outstanding claims, ensuring a prompt resolution.

Creating an efficient monthly reporting system is equally essential as it enhances the competence of medical billing. By implementing this system, you can also determine the progress of your practice’s revenue. Regularly analyzing these reports enables healthcare professionals to make informed decisions that positively impact financial stability.

Accounts receivable aging reports organize denials based on the days payments have been outstanding. The longer claims linger in the aging bucket, the higher the likelihood of reduced reimbursement. This emphasizes the role of the AR recovery.

An efficient denial management and AR follow-up team are essential to address this challenge. Their responsibility is to:

These efforts continue until payments are collected and claims are successfully closed, ensuring optimal financial health for your medical practice.

Smooth account receivable management helps recognize the key challenges when handling and closely working with insurance companies’ claim denials. This identification enables the creation of an action plan to prevent future occurrences of such claims and denials. Several challenges in the Account Receivable Process include:

An efficient AR recovery process ensures a healthier financial flow. It enables you to provide better services, invest in new equipment, and grow your practice.

Maintaining a low A/R avoids non-payment risks and ensures operational efficiency through effective A/R management. These are vital elements for a successful AR recovery process in medical billing.

Patient outreach stands as an important strategy in the accounts receivable process. Drafting letters to seek patient assistance in the claims resolution process is a practical approach. It is essential to request specific information during patient outreach. The letter should be comprehensive, covering details on:

This approach informs the patient about the efforts invested in securing payment for their claim and builds trust. Patients, in turn, become willing to assist if any issues come up with the insurance company during the claim processing cycle.

Patient outreach is a valuable component of the AR recovery process. By communicating transparently with patients, sharing information about claim efforts, and seeking their assistance, healthcare providers strengthen their relationships with patients and enhance the efficiency of claims resolution.

Share:

Categories

Recently Added

What is an ABN in medical billing?

What does a Clearinghouse do During Claims Submission?

What is EOR in Medical Billing?

We Would Love to Assist You!

We treat your data confidentially and don’t share any information with a third party.