Email: info@prgmd.com | Call: +1 (630) 242-6474

Business hours: 9:00 to 5:00 | Monday to Friday

Email: info@prgmd.com | Call: +1 (630) 242-6474

Business hours: 9:00 to 5:00 | Monday to Friday

Table of Contents

ToggleAs a healthcare practitioner, you must have heard the term payment posting, but what exactly is payment posting in medical billing? The payment posting process examines the payments and the financial status of a healthcare practice. Payment posting in healthcare revenue cycle management entails the recording of payments. It offers a clear outlook on the following:

While the payment posting process is a straightforward activity in medical billing, it is still one of the most important and the first stages of total revenue cycle management. To save time and reduce inconveniences, it is vital for a medical practice to determine and then address potential problems right from the get-go.

Key Takeaways:

Once the claims are submitted, the payer steps in to review them. They evaluate the claims to determine the reimbursement amount for the healthcare provider. This determination relies on factors like the:

After receiving payments, the next step in the payment posting process is accurately entering these payments into the provider’s billing system. This includes recording the following:

Equally important in medical billing is reconciliation. This involves two key aspects:

(a) Comparing and verifying received payments—from government programs, insurance companies or patients—with the billed charges for provided healthcare services

(b) Cross-checking Electronic Remittance Advices (ERAs) with corresponding bank deposits. This process ensures that every dollar collected enters the provider’s bank account.

During payment reconciliation, discrepancies may surface due to various reasons, such as:

Identifying these discrepancies is an essential part of the payment posting process. It demands quick action to resolve these issues and maintain accuracy in financial records.

If discrepancies are identified, the provider may find it necessary to initiate appeals with the payer. This step is vital for addressing denied claims or correcting incorrect payments. It might involve submitting additional documentation or providing clarifications to strengthen the claim.

For instance, consider a scenario where a coding error led to a claim denial. The provider can correct this by submitting the correct codes along with any supporting documentation during the appeals process.

Following the resolution of discrepancies, providers proceed to balance their accounts and generate reports. These reports help in:

Exploring the payment posting process in medical billing reveals two different methods:

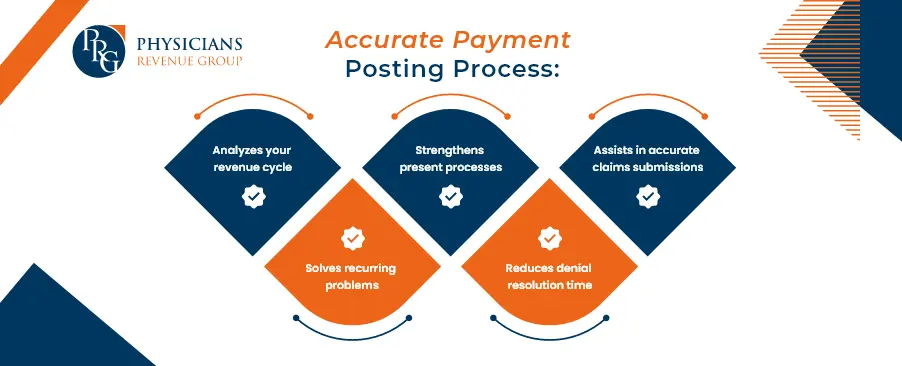

Payment posting is essential in the medical billing process, a vital component of RCM in healthcare. Here, we delve into the key benefits that accurate payment postings bring to your practice, including:

In conclusion, effective payment reconciliation demands thorough attention, insurance contract knowledge, and swift error resolution. Despite the option of streamlining with billing software, the process necessitates time, resources, and an updated understanding of medical billing guidelines and payer policies. Due to its complexity, many medical practices and healthcare enterprises find outsourcing the payment posting process and reconciliation a practical choice. This strategic decision allows professionals to concentrate on core responsibilities while ensuring accurate financial management through specialized services.

Share:

Categories

Recently Added

What is an ABN in medical billing?

What does a Clearinghouse do During Claims Submission?

What is EOR in Medical Billing?

We Would Love to Assist You!

We treat your data confidentially and don’t share any information with a third party.